Sharing some info since I'm a California transplant that has lived in Houston as well…the first question I had when I moved here was:

Why is El Paso's Tax Rate so high?

The Lincoln Institute’s Property Tax study puts El Paso’s effective tax rate for homeowners at 2.67%. In 2020, the average effective tax rate among the 50 largest cities in the U.S. was 1.40%.

One reason El Paso’s tax rate is the second-highest among big cities is that its median home value is among the lowest. You can buy roughly the same size and quality house in El Paso for cheaper than you can in cities such as Albuquerque, San Antonio or Tucson.

“First, let’s start with how taxes are calculated:

Property Taxes = Assessed Value * Tax Rate

An important thing to know, especially while house shopping, is that property tax rates in Texas are set by each local taxing authority, which can be cities, school districts, counties, and sometimes other special districts to fund bridges or hospitals. This means that property tax rates literally vary by neighborhood, even within the same city.

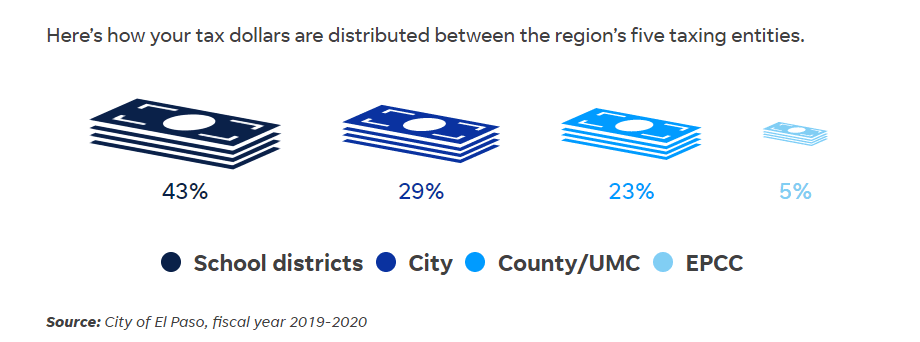

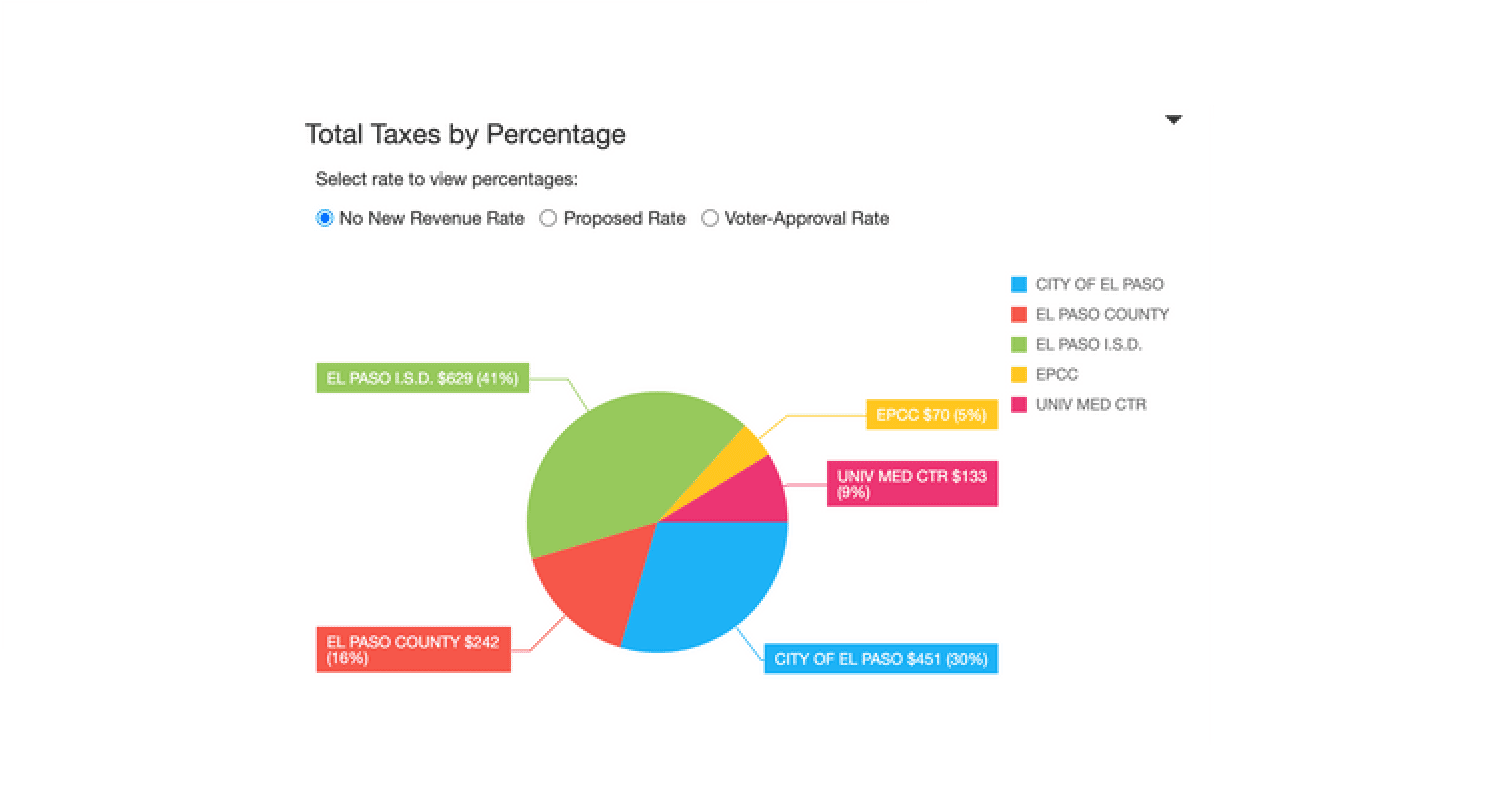

The property tax bill for residents who live in El Paso city limits is split among five different taxing entities: a school district, the city of El Paso, El Paso County, University Medical Center and El Paso Community College.

Your Realtor can tell you the property tax rate for a specific house or can guide you to specific areas if a lower tax rate is a priority. You can also look this up for a specific house with the county tax assessor website. Avoid 3rd party websites that show tax rates as they're usually WAY off.

Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to limit tax increases. Property owners have the right to know about increases in their properties' appraised value and to be notified of the estimated taxes that could result from the new value.

Building new communities – especially master planned communities is expensive, and the money will ultimately come from somewhere. There are essentially 3 ways for developers to pay for the costs of streets and bringing in sewer and other utilities: 1) MUDs, 2) PIDs, or 3) the Developer foots the bill and ultimately builds this into your lot and therefore home price. You will generally find that new homes in neighborhoods with MUDs or PIDs are a little bit cheaper than neighborhoods without – so while many people want to avoid MUDs or PIDs, you're still paying for the infrastructure in one way or another, even if it's a higher up-front house cost.

There's a Truth in Taxation website for El Paso, but it doesn't work. Here's the link anyways:

https://elpaso.truthintaxation.com/

New home builders are often accused of not being as up front about MUDs and PIDs as they should be (and from my personal experience the builder reps talking to you are often not knowledgeable about this), and here we find reason # 465 why you should always use a Realtor, even for buying a new home, which costs you nothing.

Municipal Utility Districts (MUDs) impose an additional tax instead of a city tax (they are technically a municipality like a city and must provide or contract out for police, fire, and other services) and often will have a long-term annexation agreement to officially become part of a bordering city. In DFW, you'll typically see neighborhoods with MUDs charge around a net of about 0.5% higher than the city tax in the surrounding or neighboring city. In Houston, some communities are significantly more. I believe in El Paso, Horizon has a MUD.

The newest neighborhoods are moving towards instead using Public Improvement Districts (PIDs) where there is (usually) a set dollar amount (usually between $12,000 and $30,000) assessed per property, often determined by lot size, and paid off over 30+ years along with your taxes. Sometimes the city creates a Tax Increment Reinvestment Zone (TIRZ) to help induce development in that area. If this is the case, then they will rebate some of the incremental property tax money back to YOU to offset your PID payments.

Texas, like most states (other than California), reassess the property values each year, as of January 1st. In Texas, the sales price of your home is private and not shared directly with the government, so they have to make an educated guess. They may send you a form asking you to voluntarily disclose the sales price, but I’d recommend you file this straight in the trash and ask the seller to do the same. If you’re not happy with their yearly assessment, you can protest it, which I recommend you do every year, which will ultimately reduce your property taxes.

Appraised values are typically lower than the true market value. Sometimes by a large amount. More rural or smaller counties tend to be much less aggressive than urban larger cities. Your Realtor can tell you (or you can look it up) what a house is currently assessed at. It won't change just because there is a sale (unlike CA).

Will your property taxes go up each year? Probably. This happens in California too, but, like California, there are some limits in place. First, your assessed value of your primary home is capped at a 10% maximum increase in any year. You probably know there was a big jump in values this year (nationwide, not just Texas).

Wow, what a windfall for the government, right? Well, no, your property taxes, in dollars, won’t be going up 8% just because the property values increased. Property tax reform put in place in 2019 limits most taxing authorities to a 3.5% year over year aggregate tax increase without putting it up for a vote. To do this, they’re forced to reduce the tax *rate* in order to lower the tax revenues to no more than 3.5% greater than their revenues last year.

That means the values of the property will make up the bulk of the increases. The Central Appraisal District's separate market valuation for a home is important because that will be used in future years to determine the taxable value increase. So, if a home's market value has a large market value increase this year, that could cause the taxable value to increase 10% per year in the future until the taxable value catches up to the higher market value.

City of El Paso tax rate is up 39% since 2010!!!

In the last decade, the city's tax rate has gone up 39% from 63 cents in 2010 to 91 cents in 2021.

The money generated by the city’s tax rate funds two major categories: debt and the general fund. Of those two parts, the cost of the general fund has risen 42%, or 19 cents in the last decade. The debt portion of the city’s spending has grown 9 cents in that same time, or 32%.

Per the City's page: “CITY OF EL PASO ADOPTED A TAX RATE THAT WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS THAN LAST YEAR'S TAX RATE; AND THE TAX RATE WILL EFFECTIVELY BE RAISED BY 3.13 PERCENT”

https://www.elpasotexas.gov/omb/tax-code/

El Paso’s property tax rate for homeowners within the El Paso Independent School District went up 21% in the last decade. The property tax revenue collected from those rates, which is split among five different taxing entities, rose nearly 70% to roughly $326 million since 2011.

House Bill 3, which Gov. Greg Abbott signed into law in early June 2019, requires school districts to lower their property tax rate in an effort to lessen the burden of funding public education on local taxpayers.

Another question I had since my in-laws retired here:

Will retirees be taxed out of their home in Texas ?

If you are over 65, they permanently freeze the taxable value of your home for the school district portion of your taxes, which is typically about 2/3 of your overall taxes. Many cities and counties also voluntarily reduce taxes for over-65 as well. And if that burden is too much for seniors, there is an option to defer all property taxes until after death, where it is then settled out of the estate.

Disabled veterans (thank you for your service, and your sacrifice!) – get discounts on their property taxes, and for those that are 100% service-related disabled pay no property taxes at all!

There are also a number of additional exemptions in place, such as agricultural (“Ag”) exemptions. Ag exemptions let you pay just a small fraction of the normal property tax for land with agricultural use. I won’t get into how to qualify here as it is it’s own topic, but typically you’ll see a 1 acre homesite at normal property tax rates, with the remaining acreage with an ag exemption. No you can't get an Ag exemption in a suburban master planned community.

Important things to know –

1. You will need to file your Homestead Exemption (only once) after you buy your home.

2. You will need to file any other exemptions, such as Over-65, disabled veteran, etc. They don’t automatically know.

3. After you purchase a home, you'll get a handful of official-looking scam letters in the mail offering to file your homestead exemption, of course with a fee. Throw those away and file the one-page form, probably even online, for free with your county.

4. If you purchase a new build, be aware that your current assessed value (and therefore first year taxes) are based on whatever was there as of January 1st. Next January 1st, they’re going to assess for the first time your completed house, so you’ll probably see a big jump from the value of your dirt lot to beautiful completed house. People not realizing why this happens is the main reason for people freaking out about property taxes having a huge year-over-year jump. It works the same way in CA, except that they’ll send you a supplemental bill so they don’t lose even a day of taxes. So either get your lender to base your monthly tax payment on your purchase price (and get a fat refund after the first year) or plan ahead and remember that it is expected to go up significantly in year 2 after your house is fully appraised for the first time.

5. Every year you’ll get an assessment document in the mail from your county appraisal district around April. I recommend you protest this every year, regardless of how much or how little it goes up. There is a hard deadline to protest, which will vary by county but usually about 30 days after you get your letter, typically in April or May. We protested last year with a lawyer at Legalshield and won. My friend and I both bought our houses in 2020, our tax increased last year, we both fought it and won, and we didn't get an increase this year.

You should protest as you have nothing to lose and potential to gain! Here's the link to the service we used:

https://jsolo.wearelegalshield.com/we-are-legalshield

The settlement offer is automatically made for online protests. People who protested by mail will receive a letter notifying them of their board hearing date and the opportunity to try to settle the valuation dispute with an appraiser prior to the hearing. Property owners who protested their valuations can try to settle the dispute with an appraiser prior to having a hearing before a district Appraisal Review Board.

6. The Homestead exemption doesn't kick in the first year, so theoretically you don't have the 10% limit on assessed value the first year. In the event they assess it for more than you paid, most people are successful by protesting and providing a copy of their closing documents to get the assessment to match your sales price.

You can file an appraisal protest online, and they give most people an informal “offer” in order to avoid having so many hearings, so you’re almost guaranteed a reduction with little work. If they don’t give you an informal offer, or you’re not happy with it, they will schedule a hearing, which is currently done via phone with a board made up of citizens where you will present evidence why you think their appraisal is too high. Evidence is typically having your Realtor giving you comps (remember, they don’t have all sales prices since they’re not disclosed in Texas), citing maintenance issues, citing nuisances, or other reasons why your value should be lower.

https://epcad.org/ProtestsAndAppeals#protests

Finally, it’s important to understand that the bulk of taxes in Texas are paid via property taxes and sales taxes. Your taxes stay local and you will see your taxes at work in ways that you don’t in California. There is no state income tax, and your car registration is about $75, even if you drive a Ferrari!

Since it is such a big amount, it's up to us to keep the local officials accountable for the spending and use of our tax dollars.

How do you hold them accountable? By researching their positions and registering to VOTE. Your VOTE has extreme power here in El Paso. Especially since at the March primaries, El Paso County had a voter turnout of ONLY 11%, along with about 845 mail-in ballots that were rejected under new Texas voting laws, the county elections administrator said. That's like 11 people showing up to a party meant for 100 and one vote could potentially change an election! Early voting for the May 24 primary runoff election begins May 16, 2022. The general election is in November 2022.

Register here:

https://epcountyvotes.com/voter_information/voter_registration

Values went up, so taxes did too, but what are we getting for it?

I find it troubling that the city is using tax payer funds to hire lawyers to block the release of reviews…

“The last two years, the city has tried to withhold the reviews of the city manager, a shift in policy as evaluations were routinely released before his contract was renewed in 2018.

Further analysis by KTSM found the city hired outside law firm Davidson, Troilo, Ream & Garza, P.C., a San Antonio-based firm, to assist the city attorney’s office in withholding the individuals reviews. The city paid nearly $25,000 to the law firm for its assistance to in the evaluation process and to keep documents out of public view.

The law firms receipts and invoices were redacted so as to not explain why the city was being billed for certain services. The city later clarified $3,000 out of the total were used to oppose the release of individual evaluations to the public.”

https://www.google.com/amp/s/www.ktsm.com/local/el-paso-news/el-paso-city-manager-pay-exceeds-400000/amp/

If you got this far, thank you for reading, and you now know more than most as to how property taxes work in Texas.